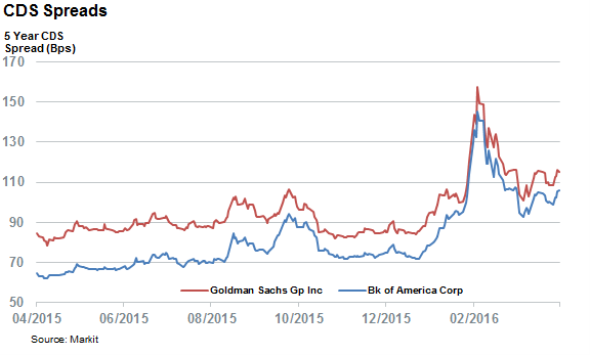

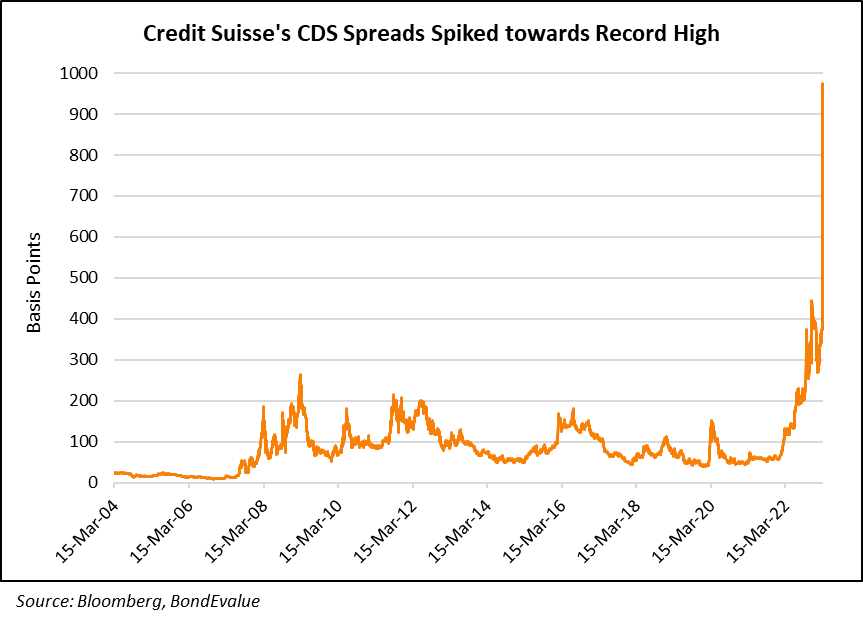

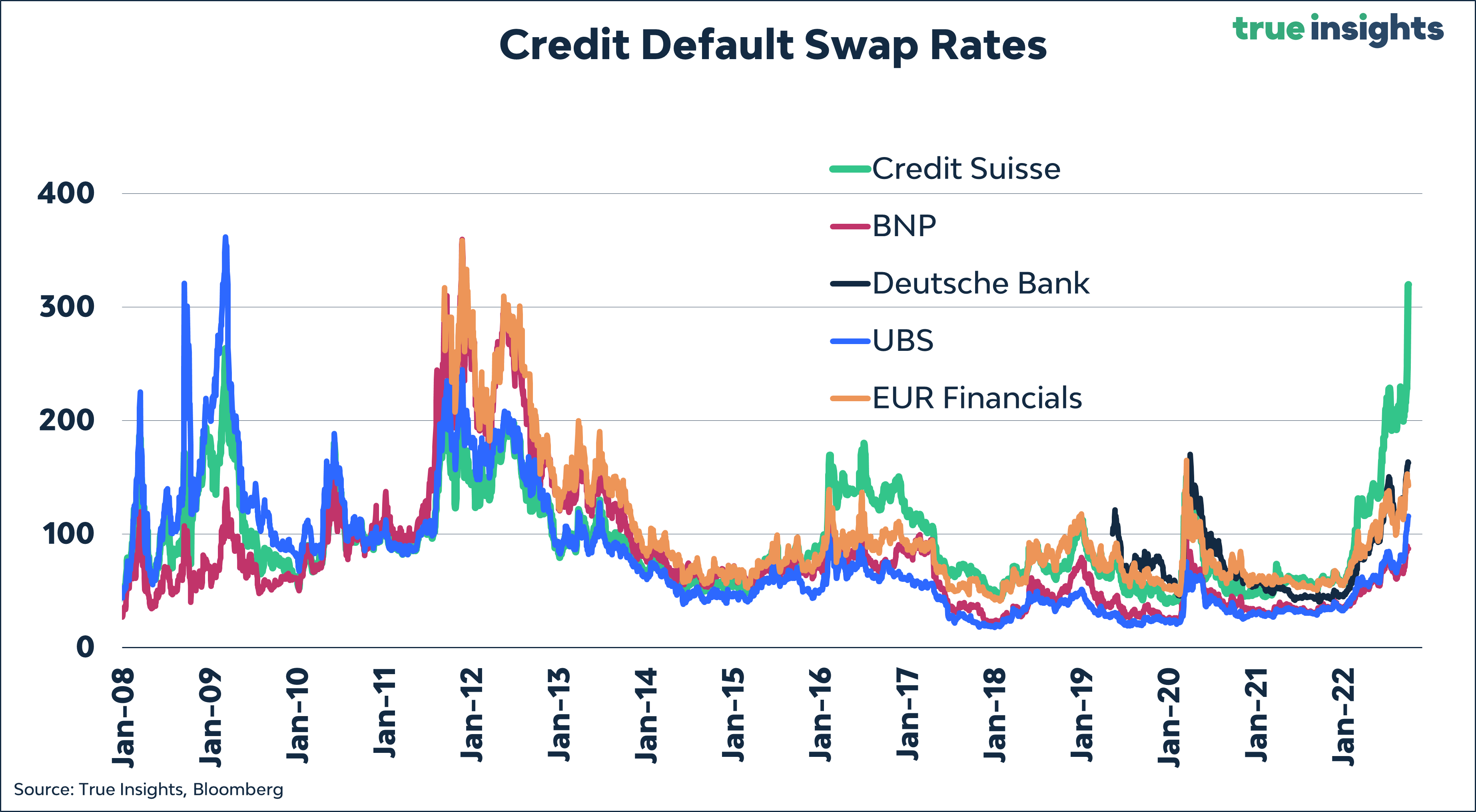

jeroen blokland on X: "The CDS spread of #CreditSuisse is the clear outlier with a spread above 300 basis points. 2X the spread of 25 financial institutions in the Markit iTraxx benchmark,

Profit Idea - DID YOU KNOW ? What is a Credit Default Swap (CDS)? A credit default swap (CDS) is a financial derivative or contract that allows an investor to "swap" or

The Pricing of Credit Default Swaps During Distress in: IMF Working Papers Volume 2006 Issue 254 (2006)

CDS premium and bond spread for each sovereign entity. The figure shows... | Download Scientific Diagram

:max_bytes(150000):strip_icc()/Term-Definitions_Credit-default-swap-63dfdd6f916e4dfa8fb524fc387273c6.jpg)